We may earn a commission for purchases through links on our site, Learn more.

If you’ve just become a Capital One account holder, you might find yourself pondering over the process of accessing your account online. The reassuring news is that navigating the login procedure for your Capital One account is a straightforward process, regardless of whether you’re using a computer, smartphone, or tablet to do so. By following a few clear steps, you can seamlessly gain access to your account, and this guide will walk you through the process while also addressing potential hiccups you might encounter.

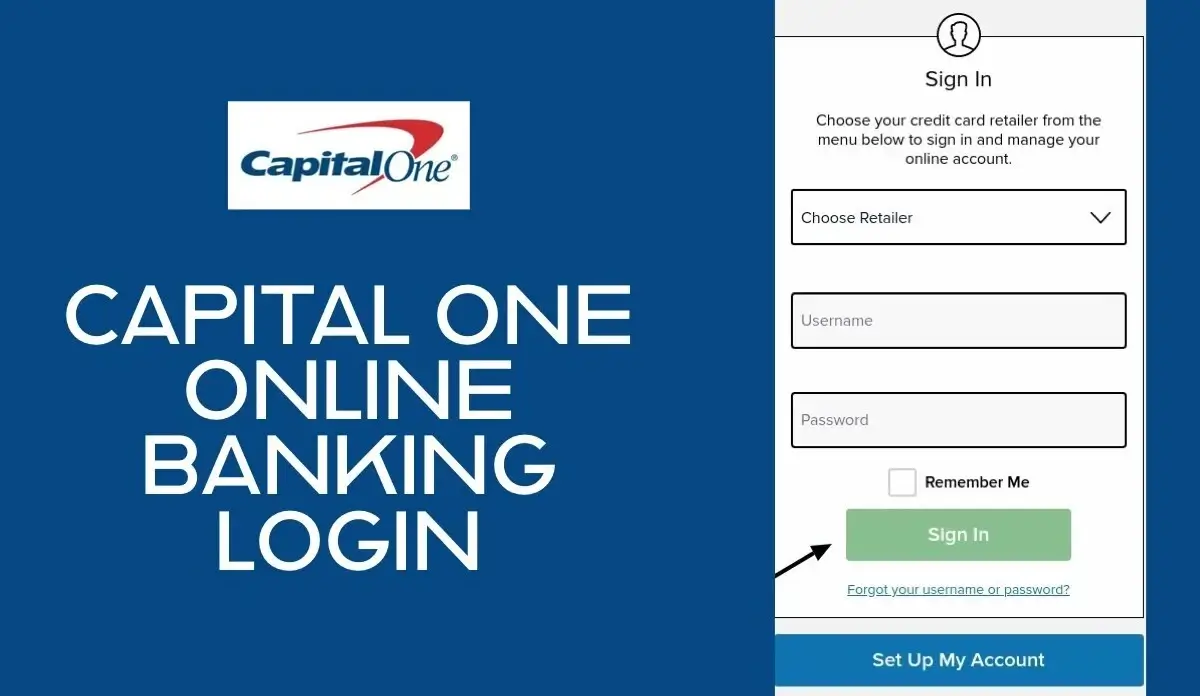

Capital One login

Logging in to your Capital One account is designed to be user-friendly and efficient. Whether you’re at home or on the go, you have the flexibility to log in using a device that suits your convenience. If you’re using a computer, simply navigate to the official Capital One website, where you’ll easily spot the login section. For those who prefer the ease of their smartphones or tablets, the Capital One mobile app provides a dedicated platform for managing your account while on the move.

In the event that you forgot your password, don’t fret. Capital One has implemented a streamlined password retrieval process to alleviate this situation. By selecting the appropriate option on the login page, you can initiate the password recovery procedure. This typically involves confirming your identity through security questions or receiving a verification code via email or SMS. Once authenticated, you can reset your password and swiftly regain access to your account.

However, should you encounter any obstacles during the login process or while attempting to recover your password, Capital One’s robust customer support is readily available to assist you. Their customer service team is well-equipped to handle a variety of issues, ranging from technical glitches to account-specific queries. You can easily locate their contact information on the official Capital One website or within the mobile app. Reaching out to their support channels provides a direct line to resolving any challenges you might face.

How to set up your Capital One login information

Setting up your Capital One login information is a straightforward process that grants you access to their online services. If you’re new to Capital One’s digital platform, follow these steps to set up your online account:

- Access the Setup Page: Begin by visiting the Capital One homepage. There, you’ll notice a “Sign in” button prominently displayed. Directly below this button, you’ll find a link labeled “Set up online access.” Click on this link to initiate the setup process.

- Provide Personal Information: On the subsequent page, you’ll be prompted to provide essential personal details. These details serve as a means of verification to ensure your account’s security. Specifically, you’ll need to enter your last name, Social Security number, and date of birth. If you have reservations about using your Social Security number, Capital One offers an alternative option: you can opt to use your Capital One account number instead.

- Select Username and Password: As the next step, you’ll be prompted to create a unique username and a secure password. It’s vital to choose a username that’s both memorable and distinguishable. Your password should be a combination of letters, numbers, and special characters to enhance security. Be sure to select a password that’s not easily guessable but is still easy for you to recall.

- Complete Setup: Once you’ve chosen a username and password, proceed to finalize the setup process. Double-check all the information you’ve entered to ensure accuracy. This step ensures that you’ll be able to seamlessly access your Capital One account whenever you need to manage your finances online.

By following these steps, you’ll successfully set up your Capital One online access. This will empower you to conveniently view your account details, track transactions, make payments, and perform various other financial activities from the comfort of your own device. Remember to keep your login information confidential and secure, as this is crucial for safeguarding your financial data.

How to log in to your Capital One bank account from a computer

Logging in to your Capital One Bank account from a computer is a straightforward process that grants you convenient access to manage your account online. Once you’ve established your login credentials, you’re ready to follow these simple steps to securely sign in:

- Access the Capital One Homepage: Begin by opening your preferred web browser and navigating to the official Capital One homepage. This can usually be done by typing “www.capitalone.com” into the address bar and hitting “Enter.”

- Provide Your Credentials: On the Capital One homepage, you will see designated fields for your username and password. Carefully enter the username you selected during the account setup phase into the appropriate field. Ensure accuracy to prevent any login issues.

- Enter Your Password: In the adjacent field, input your confidential password. Take care while typing to accurately reproduce the characters, as passwords are case-sensitive and must match exactly.

- Initiate the Sign-In Process: Once you’ve entered your username and password, direct your attention to the “Sign in” button, typically located beneath the login fields. Click this button to initiate the sign-in process.

- Optional: Enable “Remember Me” Feature: For added convenience, consider utilizing the “Remember me” option located beneath the username field. By selecting this checkbox, the website will store your username on the device you’re using, allowing it to be auto-filled the next time you load the Capital One homepage. This feature can save time and effort during subsequent logins.

As you proceed through these steps, it’s essential to prioritize the security of your personal and financial information. Ensure that you’re using a private and secure internet connection, avoid using public computers for sensitive tasks, and always log out of your account when you’re finished to prevent unauthorized access.

By following these instructions, you’ll be able to access your Capital One Bank account from a computer with ease, facilitating seamless management of your finances and transactions from the comfort of your own home or office.

How to log in to your Capital One bank account from a mobile phone or tablet

Logging in to your Capital One Bank account using the mobile app provides a convenient and secure way to manage your finances on the go. Follow these steps to access your account effortlessly:

- Download the App: Begin by downloading the Capital One mobile app from either the App Store (for iOS devices) or Google Play Store (for Android devices). Search for “Capital One Mobile” and look for the official app developed by Capital One.

- App Installation: Once the app is downloaded, tap on the app icon to launch it. The app will guide you through an initial setup process, including permissions it may require to function optimally on your device. Ensure you grant the necessary permissions for a seamless experience.

- Initial Login Screen: Upon opening the app, you’ll be greeted with the login screen. This is where you’ll enter your credentials to access your account. Type in your registered username and password in the designated fields.

- Secure Access: After entering your login credentials, tap the “Sign In” button. Capital One prioritizes security, so rest assured that your information is being protected through encryption and other robust security measures.

- Biometric Authentication (Optional): To streamline your future logins and enhance security, Capital One offers the option to set up biometric authentication, such as fingerprint recognition or facial recognition. If your mobile device supports these features, the app will prompt you to opt in. This adds an extra layer of protection, ensuring that only you can access your account with ease.

- Opting for Biometric Authentication: If you choose to enable biometric authentication, follow the prompts to set it up. This usually involves scanning your fingerprint or allowing the app to scan your face. These features add an additional level of convenience and security by allowing you to log in without typing your username and password each time.

- Accessing Your Account: Once you’re logged in, you’ll have full access to your Capital One Bank account. You can view your account balances, transaction history, make transfers, pay bills, and manage various banking tasks directly from the app.

- Logging Out: When you’re done using the app, it’s important to log out for security reasons. This is especially crucial if you’re using a shared or public device. To log out, navigate to the menu or settings section of the app, where you should find the option to log out or sign out.

By following these steps, you can easily log in to your Capital One Bank account using their mobile app, ensuring a convenient and secure way to handle your banking needs anytime and anywhere.

How to retrieve a forgotten username or password

In today’s digital age, where every online account seems to have its own intricate password, it’s not uncommon to find yourself grappling with forgotten login credentials. Whether it’s the deluge of security codes or the sheer uniqueness of each password, memory lapses can occur. So, let’s consider a scenario where the particulars of your Capital One account evade your recollection. Not to worry, though, as there is a systematic approach to regain access:

- Navigate to the Capital One Homepage: Start by opening your web browser and directing it to the Capital One homepage. This can usually be accomplished by entering “www.capitalone.com” into the address bar and hitting Enter.

- Access the Account Recovery Option: Upon arriving at the homepage, scan the screen for the “Forgot username or password?” link. Typically situated beneath the space designated for entering your password, this link is your gateway to the recovery process.

- Submit Your Identification Details: The system will guide you to a recovery page. Here, you’ll be prompted to input specific personal details for verification purposes. Among the information required are your last name, Social Security number, and date of birth. By furnishing these details accurately, you help the system confirm your identity and protect your account’s security.

- Initiate the Search: Once all the requisite fields are populated with your accurate personal information, summon the next step by clicking on the “Find Me” button. This action sets the recovery process in motion.

- Await the Confirmation Email: Provided the information you provided aligns with your account’s records, a confirmation email will wing its way to your registered email address. This email holds two crucial pieces of information: your forgotten username and a link that facilitates the reset of your password.

- Retrieve Username and Reset Password: Open the confirmation email and take note of your rediscovered username. This is your digital identity to access your Capital One account. Furthermore, follow the provided link to reset your password. This link will direct you to a password reset page, where you can establish a new, secure password that will safeguard your account going forward.

By meticulously following these steps, you can seamlessly regain access to your Capital One account even when the labyrinth of passwords has momentarily obscured your path. Remember, in the realm of digital security, diligent retrieval methods are the compass guiding you back to the virtual domains you’ve staked your claim in.

How to contact Capital One customer service

If you find yourself needing to reach out to Capital One’s customer service, you’ll be pleased to know that they offer a range of options tailored to your specific needs. Your choice of method depends on the reason behind your contact. Here are some avenues you can explore:

- Capital One Banking Customer Support: For inquiries related to your banking needs, whether it’s about your account balance, transactions, or general banking queries, Capital One’s banking customer support team is available to assist you. Their support hours are quite accommodating, spanning from 8 a.m. to 8 p.m. seven days a week. When you’re ready to connect, simply dial 800-289-1992 and a knowledgeable representative will be at your service to address your concerns.

- Credit Card Customer Service: If your inquiry pertains to your credit card account, Capital One has your back with round-the-clock support. This means you can reach out at any time, day or night, and expect to receive assistance promptly. Whenever you need help with your credit card-related matters, don’t hesitate to dial 800-227-4825. Whether it’s a question about your credit limit, recent transactions, or rewards, their dedicated credit card customer service team will be ready to lend a hand.

- Online Banking Support: Navigating the world of online banking can sometimes be a bit confusing, and that’s where Capital One’s online banking support comes into play. If you encounter any difficulties with logging in, setting up transfers, or managing your online account, rest assured that expert help is just a call away. Reach out to them at 866-750-0873 for guidance tailored to your online banking needs.

- Fraud Protection: Discovering that you might be a victim of credit card fraud can be distressing, but Capital One is equipped to assist you in such situations. If you suspect unauthorized activity on your credit card or believe you’ve fallen victim to fraud, it’s crucial to act swiftly. Contact Capital One’s dedicated fraud protection team at 800-427-9428 to report the issue. They will guide you through the necessary steps to secure your account and investigate any potential fraudulent activity.

In a world where customer service plays a pivotal role in ensuring a seamless banking experience, Capital One has diligently provided various contact avenues to cater to the diverse needs of their customers. Regardless of your inquiry, these well-defined channels demonstrate their commitment to providing assistance and maintaining the security of your financial affairs. So, whether you’re a traditional banker, a credit card enthusiast, an online banking aficionado, or a vigilant protector of your financial assets, Capital One’s customer service is ready to offer the help you need.

If you’re unsure who you need to communicate with at Capital One, you can call 877-383-4802 for assistance.

What are the benefits of online banking?

Online banking offers a multitude of advantages that cater to the modern lifestyle. These benefits not only simplify financial management but also provide a higher degree of convenience and control over your monetary affairs. Some of the most noteworthy advantages are as follows:

- Global Accessibility: One of the primary perks of online banking is the ability to access and oversee your accounts from virtually anywhere across the globe. Whether you’re on vacation, at work, or simply relaxing at home, you can log into your online banking portal and gain real-time insights into your financial status. This eliminates the need for guessing how much money you have at any given moment and empowers you with immediate information.

- Convenient Account Management: Online banking allows you to effortlessly monitor and manage your bank accounts. Through a user-friendly interface, you can track your transactions, monitor your balances, and review your transaction history. This level of oversight enables you to promptly detect any discrepancies or unauthorized transactions, enhancing your financial security.

- Automatic Bill Payment: The anxiety of missing bill payments becomes a thing of the past with online banking. By utilizing features like automatic bill pay, you can schedule recurring payments for your utilities, loans, and credit cards. This ensures that your bills are settled on time, helping you avoid late fees and maintaining a strong credit history.

- Effortless Fund Transfers: Online banking platforms, such as Capital One’s, offer seamless options for transferring funds between various accounts. Whether you need to move money from your checking to savings account, or vice versa, you can accomplish this task with a few clicks. This streamlined process is far more convenient than traditional methods of visiting a bank branch or writing physical checks.

- Time-Saving: Online banking saves you precious time that would otherwise be spent commuting to a physical bank location. With just an internet connection, you can perform various banking tasks within minutes. This allows you to allocate your time more efficiently towards other important activities.

- 24/7 Availability: Unlike traditional banking hours, online banking services are available around the clock. This means you can perform transactions, check your account status, or address any concerns at any time, even during weekends and holidays.

- Paperless Statements: Online banking contributes to environmental sustainability by reducing the need for paper statements. You can receive your account statements electronically, minimizing paper waste and clutter.

- Enhanced Security Features: Reputable online banking platforms employ advanced security measures to protect your financial data. These may include multi-factor authentication, encryption, and real-time fraud monitoring, providing a level of security that rivals or even surpasses that of physical banking.

In summary, the benefits of online banking, as exemplified by Capital One’s platform, encompass convenience, accessibility, efficiency, and security. By embracing these digital financial tools, individuals can take greater control over their finances and simplify their banking experience in today’s fast-paced world.

How do I open my Capital One account?

Opening a Capital One account is a straightforward process that can be conveniently done online. To initiate the process, follow these steps:

- Access Capital One’s Website: Start by navigating to the official Capital One website using your preferred web browser. Ensure that you’re using a secure and trusted network to protect your personal information.

- Select Your Desired Account Type: Once on the website, explore the various account options available. Capital One offers a range of accounts, such as checking, savings, and credit card accounts. Carefully review the features and benefits of each type to determine which one aligns best with your financial needs and goals.

- Complete the Application: After deciding on the type of account that suits you, proceed to fill out the online application form. This form will typically require personal details such as your full name, contact information, social security number, and other relevant identification details. It’s important to provide accurate information to ensure a smooth application process.

- Authorization and Information Collection: As part of the application process, you may be required to agree to Capital One’s terms and conditions and authorize them to collect certain information for verification purposes. This could include verifying your identity through external databases or credit bureaus.

- Review Approval Process: Once you’ve submitted your application, Capital One will review the information provided. They may perform a credit check and other assessments to determine your eligibility for the chosen account. You might receive an immediate decision or need to wait for a notification regarding the status of your application.

- Make Your Initial Deposit: If your application is approved, you’ll be instructed on how to make your initial deposit. This step is essential, especially for deposit accounts like savings or checking accounts, as it establishes your account’s funding. Capital One will provide instructions on transferring funds from another bank account or making a deposit through alternative methods.

- Access and Manage Your Account: Once your initial deposit is confirmed, you’ll gain access to your new Capital One account. You can set up online banking, download the mobile app, and start managing your finances from the comfort of your home. Remember to set up strong security measures, such as unique login credentials and two-factor authentication, to protect your account.

It’s important to note that specific steps and requirements may vary based on your location and the type of account you’re opening. Additionally, always prioritize security by ensuring you’re on the official Capital One website and by avoiding sharing sensitive information over unsecured networks.

How do I access my Capital One account?

Accessing your Capital One account is a convenient and flexible process, designed to cater to your preferences and needs. Here are the various ways you can access your account:

- Online Banking: Capital One offers a user-friendly online banking platform accessible through their official website. Simply visit the website, click on the “Login” or “Sign In” button, and enter your username and password to securely access your account. Once logged in, you can manage your finances, view transactions, pay bills, and more, all from the comfort of your own device.

- Mobile App: The Capital One mobile app provides a seamless and on-the-go banking experience. You can download the app from your device’s app store, install it, and then log in using your credentials. The app allows you to perform various tasks, such as checking your account balance, depositing checks using your phone’s camera, setting up alerts, and making payments.

- Capital One Café: If you’re looking for a more personalized touch, you can visit a Capital One Café. These unique spaces offer a combination of banking services and café amenities. Knowledgeable staff are available to assist you with your banking needs while you enjoy a cup of coffee. It’s a relaxed environment where you can have your questions answered and receive in-person guidance about your account.

- Physical Branch: If you prefer traditional banking, you can visit a physical Capital One branch. At the branch, you can speak with bank representatives face-to-face, discuss your financial goals, open new accounts, apply for loans, and access a range of in-person banking services.

Remember to keep your login credentials secure and private to ensure the safety of your account. Additionally, if you ever encounter issues with accessing your account or need assistance, Capital One’s customer support is readily available to help through their website, app, or by phone.

Whichever method you choose, Capital One aims to provide you with a hassle-free and accessible way to manage your finances according to your preferences.

How do I check my Capital One credit card account online?

Checking your Capital One credit card account online is a convenient and straightforward process. The steps to access your account are the same for both credit card and bank accounts. Here’s a detailed walkthrough:

- Open a Web Browser: Launch your preferred web browser (such as Google Chrome, Mozilla Firefox, or Safari) on your computer or mobile device.

- Navigate to the Capital One Homepage: Type “www.capitalone.com” into the address bar at the top of your browser and press Enter. This will take you to the official Capital One website.

- Locate the Sign-In Area: Once you’re on the Capital One homepage, look for the “Sign In” section. It’s usually located at the top right-hand corner of the page.

- Enter Your Username and Password: In the designated fields within the “Sign In” section, enter the username and password associated with your Capital One account. Make sure to enter this information accurately to ensure successful access.

- Click “Sign In”: After entering your credentials, click on the “Sign In” button. This will initiate the authentication process and securely log you into your account.

- Verify Two-Factor Authentication (if applicable): Depending on your account security settings, you might be required to complete a two-factor authentication process. This typically involves receiving a code on your registered mobile device or email and entering it on the website to verify your identity.

- Access Your Account: Once you’ve successfully logged in and completed any necessary security checks, you will be directed to your Capital One account dashboard. Here, you can view your credit card balance, recent transactions, payment due dates, rewards, and other account-related information.

- Logout When Done: After you’ve finished reviewing your account details or performing any necessary tasks, be sure to log out of your account. Look for the “Sign Out” or “Logout” option, usually located in a menu or at the top of the page. This is especially important if you’re using a shared or public computer.

Remember to keep your login credentials secure and avoid sharing them with anyone. Regularly monitoring your account activity online helps you stay informed about your financial situation and can assist in quickly identifying any unauthorized or suspicious transactions.

How do I use Capital One app?

Using the Capital One app is a straightforward process that offers convenient access to your accounts, transactions, and various banking services. Here’s a step-by-step guide on how to use the Capital One app:

- Download and Install the App:

- Open the App:

- Tap on the app icon to open it.

- Log In or Sign Up:

- If you already have a Capital One account, tap on the “Sign In” option.

- Enter your username and password associated with your Capital One account.

- If you’re new to Capital One, tap on the “Sign Up” or “Register” option.

- Follow the prompts to create a new account. You’ll need your account number and other personal information to complete the registration process.

- Navigate the App Interface:

- Once logged in, you’ll land on the app’s home screen. This screen typically displays a summary of your accounts, recent transactions, and other relevant information.

- Explore Features:

- Use the navigation menu (usually represented by a menu icon, often three horizontal lines) to access different sections of the app, such as accounts, credit cards, payments, and more.

- View Account Details:

- Tap on an account to view its details, including current balance, available credit, recent transactions, and account history.

- Make Payments:

- To make payments, select the “Payments” section.

- Follow the prompts to set up one-time or recurring payments to your Capital One credit card or other accounts.

- Mobile Check Deposits:

- Some versions of the app allow you to deposit checks using your phone’s camera. Look for the “Deposit Checks” or similar option within the app.

- Security and Alerts:

- Explore the app’s security settings to enable two-factor authentication, fingerprint/face recognition, and other security features.

- Set up account alerts to receive notifications about balance changes, transactions, and payment due dates.

- Customer Support:

- Most banking apps, including Capital One’s, offer customer support options within the app. Look for a “Contact Us” or “Customer Support” section to access help when needed.

- Log Out:

- Always remember to log out of the app when you’re done using it, especially if you’re using a shared device.

Remember that app interfaces may evolve over time, so it’s a good idea to explore the app’s features and settings to get familiar with its capabilities. If you encounter any difficulties or have questions, the app’s customer support is there to assist you.

Can I use Capital One on my phone?

Certainly! In today’s increasingly digital age, utilizing the convenience of technology in financial transactions has become a common practice. When it comes to Capital One, you have the advantage of seamlessly integrating your banking experience with your smartphone through digital wallet services.

By leveraging your digital wallet, you can make payments not only in physical stores but also online and within various mobile apps. This versatility allows you to shop and pay in the way that suits your preferences and lifestyle. Capital One has embraced this trend by enabling their users to link their credit or debit cards to these digital wallets, streamlining the purchasing process and enhancing security measures.

Imagine walking into a store, selecting items you wish to purchase, and simply tapping your phone to complete the transaction. No need to fish out your physical wallet or card, as your digital wallet securely stores your payment information. Similarly, when browsing online stores or making in-app purchases, the process becomes smoother and quicker as you can simply authorize payments with a few clicks, all while knowing that your sensitive information remains protected.

This integration of Capital One with digital wallets not only offers convenience but also peace of mind. With layers of encryption and authentication mechanisms, your financial details are safeguarded against potential threats, making digital payments arguably more secure than traditional methods. Plus, in the event that your physical wallet is misplaced, you won’t have to worry about your cards being misused since they’re stored securely within your digital wallet.

In conclusion, the synergy between Capital One and digital wallet services epitomizes the modern financial landscape, where technology enhances convenience, security, and efficiency. Embracing this integration allows you to manage your financial transactions effortlessly, whether you’re buying groceries, shopping online for your favorite products, or indulging in the latest mobile app trends. The era of digital finance is here, and Capital One is at the forefront, empowering you to make transactions in a way that seamlessly fits into your digital lifestyle.

Does Capital One have mobile deposit?

Capital One offers a convenient feature known as Mobile Deposit that allows their customers to deposit checks using the Capital One Mobile app. This feature streamlines the deposit process, making it much more convenient for account holders. Here’s how it works:

Once you have the Capital One Mobile app installed on your smartphone, you can initiate the Mobile Deposit process. Start by selecting the specific account to which you want to deposit the funds. Within the app, you’ll find an option labeled “deposit,” which is typically represented by an icon resembling a camera.

Upon selecting the “deposit” option, the app will prompt you to capture images of the check you wish to deposit. It’s important to follow their guidelines for capturing these images. Make sure to photograph both the front and the back of the check clearly, ensuring that all the necessary information is visible. Prior to taking the images, you’ll need to endorse the check by writing “for Capital One mobile deposit” on the back. Additionally, don’t forget to sign your name on the designated line.

The Mobile Deposit feature utilizes the camera on your smartphone to capture these images. Once the images are taken, the app employs advanced image recognition technology to process the check and verify its authenticity. This technology helps prevent fraudulent activities and ensures the security of your transactions.

After successfully capturing and submitting the images, the app will display a confirmation of your deposit. This confirmation serves as a record of your transaction and can be useful for your personal records.

Overall, Capital One’s Mobile Deposit feature exemplifies how banking institutions are adapting to modern technology to enhance customer experiences. It eliminates the need to visit a physical branch or ATM to deposit a check, making the entire process quicker and more convenient. However, it’s important to note that while Mobile Deposit offers convenience, customers should still exercise caution and follow recommended security practices when using such features.

As technology continues to evolve, financial institutions are likely to introduce more innovative features like Mobile Deposit to cater to the changing needs and preferences of their customers.

The bottom line

In conclusion, logging to your Capital One account online is a user-friendly task that offers flexibility through various devices. The login process is designed to be intuitive, and in case you forget your password, a well-structured recovery procedure is in place. Additionally, Capital One’s dedicated customer support is always at your disposal, ensuring that you receive prompt assistance in navigating any unexpected issues. As a result, managing your finances and keeping track of your account activities with Capital One is a seamless and well-supported experience.

Now is the ideal moment to tap into the benefits of online banking if you’re a Capital One credit card holder or have an account with them. To begin this seamless transition, you have two convenient options: either visit the Capital One official website or download the dedicated mobile app. Both avenues offer a user-friendly experience designed to cater to your banking needs.

By accessing the Capital One website, you’ll open the door to a comprehensive suite of online banking tools. Logging in with your credentials grants you access to your account details, transaction history, and allows you to initiate transfers with just a few clicks. The website is optimized for ease of navigation, ensuring you can swiftly locate the information you need.

Alternatively, the mobile app encapsulates the power of online banking in the palm of your hand. Upon installation, you’ll be able to carry out a range of financial tasks from your smartphone or tablet. This means staying up-to-date with your account activity and managing payments no matter where you are. Mobile check deposits, bill payments, and fund transfers become effortless endeavors through the app’s intuitive interface.