We may earn a commission for purchases through links on our site, Learn more.

- Varo Money, Inc. operates through its own bank, Varo Bank, N.A.

- Varo Bank is a nationally chartered and FDIC-insured institution.

- Checking and savings accounts have no monthly fees or minimum balance requirements.

- Varo offers early direct deposit and competitive savings interest rates.

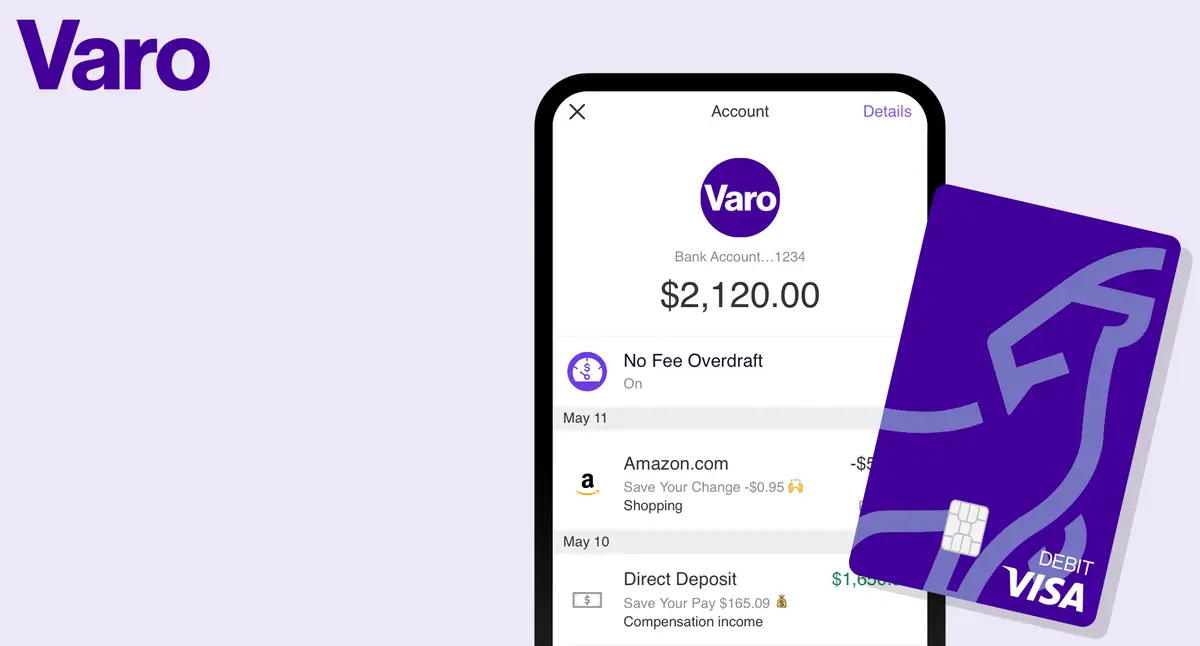

- Customers receive Visa debit cards, usable anywhere Visa is accepted.

- Free ATM access is available through the Allpoint network of 55,000+ ATMs.

- Varo provides cash advance services for quick access to funds.

- The mobile app is user-friendly, with tools for budgeting and financial tracking.

- Security measures include encryption, secure login, and fraud alerts.

Digital banking has grown significantly, offering customers the convenience of managing their finances without traditional branches. Among the many digital banks, Varo Money, Inc. stands out for its innovative services and customer-friendly approach. One of the most common questions potential customers ask is, “What bank does Varo use?”

This is an important question because understanding the banking foundation of Varo provides insight into its reliability and trustworthiness. In this blog post, we will explore everything you need to know about Varo Bank, N.A., which powers Varo Money, Inc., its services, and why it’s a great choice for digital banking.

What Bank Does Varo Use?

Varo Money, Inc. is a well-known digital banking service that prioritizes accessibility, simplicity, and cost-effectiveness. The key to its operations lies in its connection with Varo Bank, N.A., a nationally chartered bank.

By leveraging this banking structure, Varo offers customers a full range of financial products while maintaining the high standards of security and accountability expected of a regulated bank.

The question, “What bank does Varo use?” can be answered simply: Varo Bank, N.A., but the details behind this partnership reveal why Varo has become a trusted name in digital banking. This blog will delve deeper into the features and benefits that Varo provides through its banking foundation.

Varo Bank, N.A.: The Foundation of Varo’s Services

The straightforward answer to “What bank does Varo use?” is Varo Bank, N.A. Unlike many digital banking services that rely on third-party banks, Varo operates under its own national banking charter. This distinction means that Varo Bank is directly regulated by federal banking authorities, ensuring it adheres to strict standards of safety, security, and operational integrity.

Having its own charter allows Varo Bank to provide services such as checking accounts, savings accounts, debit cards, and more, all while eliminating reliance on outside banking partners. This direct control over its operations enables Varo to streamline its services, offering customers a seamless banking experience that aligns with the digital-first approach.

Checking and Savings Accounts

Varo Bank provides checking and savings accounts that are simple, accessible, and designed for modern banking needs. These accounts come with no monthly maintenance fees and no minimum balance requirements, making them an attractive option for anyone looking to avoid the typical costs associated with traditional banks.

Varo’s checking accounts include features like early direct deposit, which allows customers to access their paychecks up to two days earlier. The savings account, on the other hand, offer competitive interest rates to help users grow their money faster. These accounts are easily managed through Varo’s mobile app, which provides intuitive tools for budgeting and financial tracking.

What Makes Varo Bank FDIC-Insured?

A critical factor in evaluating any bank is its insurance status. Varo Bank, N.A. is FDIC-insured, which means that deposits are protected up to $250,000 per depositor. This federal insurance ensures that customers’ funds are safe even in the unlikely event of a bank failure.

For those asking, “What bank does Varo use?” knowing that Varo Bank is FDIC-insured provides an extra layer of trust. This protection underscores Varo’s commitment to safeguarding customer deposits and maintaining financial stability.

Varo’s Visa Debit Card

Varo Bank issues Visa debit cards to its customers, offering flexibility for everyday transactions. These cards can be used anywhere that accepts Visa, both in the United States and internationally. The Visa network ensures widespread acceptance, making it easy for Varo customers to shop online, pay bills, or withdraw cash.

In addition to their convenience, Varo’s debit cards are equipped with security features such as chip technology and contactless payment options. These measures protect users from fraud and enhance the overall safety of their transactions. For those seeking a reliable digital banking solution, the availability of a Visa debit card is a significant advantage.

Free ATM Access Through the Allpoint Network

Access to cash remains essential, even in the era of digital banking. Varo Bank addresses this need by partnering with the Allpoint ATM network. This partnership provides Varo customers with access to over 55,000 fee-free ATMs across the United States.

By offering free ATM withdrawals through the Allpoint network, Varo eliminates one of the most common frustrations associated with banking: ATM fees. This feature ensures that customers can access their money conveniently without worrying about additional costs, making Varo Bank a practical choice for managing finances.

Cash Advances for Financial Flexibility

Another standout feature of Varo Bank is its cash advance service. This option allows customers to borrow small amounts of money quickly, providing financial flexibility during emergencies. Unlike traditional loans, Varo’s cash advances are straightforward and require minimal paperwork or credit checks.

This service is particularly beneficial for individuals who need immediate access to funds but prefer to avoid the lengthy approval processes of traditional loans. Varo’s cash advance feature aligns with its mission to provide fast, accessible financial solutions for its customers.

Customer Support and Experience

Exceptional customer service is a core component of Varo’s appeal. The Varo mobile app is designed to be user-friendly, allowing customers to manage their accounts, track spending, and set savings goals with ease.

Varo also offers multiple support channels, including in-app chat and a comprehensive help center, to assist customers with their banking needs. This emphasis on customer support ensures that users have access to the information and assistance they need, reinforcing Varo’s reputation as a customer-focused digital bank.

Security Measures and Data Protection

Varo Bank prioritizes the security of its customers’ information and transactions. The mobile app uses encryption and secure login protocols to protect sensitive data. Additionally, Varo monitors accounts for suspicious activity, providing customers with alerts to help prevent fraud.

For individuals wondering, “What bank does Varo use?” knowing that Varo Bank incorporates strong security measures is crucial. These features demonstrate Varo’s commitment to creating a safe and trustworthy banking environment.

What Bank Does Varo Use? A Summary

To summarize, Varo Bank, N.A. is the bank that powers Varo Money, Inc. This nationally chartered bank provides the foundation for Varo’s digital banking services, including checking and savings accounts, Visa debit cards, cash advances, and more.

Varo Bank is FDIC-insured, ensuring the safety of customer deposits, and offers free ATM access through the Allpoint network. Its emphasis on security, customer support, and financial flexibility makes it a top choice for individuals seeking a modern, reliable banking solution.

Frequently Asked Questions

Here are some of the related questions people also ask:

What bank does Varo use?

Varo uses its own bank, Varo Bank, N.A., a nationally chartered and FDIC-insured institution.

Is Varo Bank FDIC-insured?

Yes, Varo Bank is FDIC-insured, protecting deposits up to $250,000 per depositor.

Does Varo Bank have physical branches?

No, Varo Bank is a fully digital bank and does not operate physical branches.

What type of accounts does Varo offer?

Varo offers checking and savings accounts with no monthly fees or minimum balance requirements.

Can I use Varo Bank’s debit card internationally?

Yes, Varo’s Visa debit card can be used anywhere Visa is accepted, including internationally.

Does Varo charge ATM fees?

Varo customers can access over 55,000 Allpoint ATMs nationwide for free, eliminating ATM fees.

How secure is Varo Bank?

Varo Bank employs encryption, secure authentication, and fraud monitoring to ensure customer security.

Does Varo offer early direct deposit?

Yes, Varo allows customers to receive their paychecks up to two days early with early direct deposit.

What are the advantages of Varo Bank over traditional banks?

Varo Bank offers no-fee accounts, free ATM access, early direct deposit, and a completely digital banking experience.

The Bottom Line

The question, “What bank does Varo use?” leads us to a deeper understanding of the innovative banking model provided by Varo Money, Inc. and its partner, Varo Bank, N.A. As a fully digital bank, Varo Bank offers a range of services designed to meet the needs of today’s consumers, all while maintaining the high standards of safety and reliability expected of a nationally chartered institution.

From no-fee checking and savings accounts to Visa debit cards and free ATM access, Varo delivers convenience and value in every aspect of its banking experience. Its FDIC insurance provides peace of mind, while its cash advance feature offers financial flexibility in times of need. Additionally, Varo’s user-friendly mobile app and strong customer support ensure that customers can manage their finances efficiently and with confidence.

For anyone considering a digital bank, understanding “what bank does Varo use” highlights the strengths of Varo Bank, N.A. This partnership exemplifies how a nationally chartered bank can leverage technology to create a seamless, secure, and customer-focused banking experience. With its commitment to transparency, security, and innovation, Varo Bank continues to set the standard for digital banking in the United States. Whether you’re managing everyday expenses, saving for future goals, or seeking financial peace of mind, Varo Bank provides the tools and support you need to succeed.