We may earn a commission for purchases through links on our site, Learn more.

- Affirm Savings Account offers competitive interest rates higher than many traditional banks.

- There is no minimum balance requirement, making it accessible for all users.

- The account is managed digitally through the Affirm app with a user-friendly interface.

- Automatic savings features help users save consistently without manual transfers.

- Affirm does not have physical branches, which may be a drawback for those who prefer in-person banking.

- The account is FDIC insured, ensuring the safety of deposited funds.

- Some users report mixed experiences with Affirm’s customer service.

- Fees may apply for excessive withdrawals or other account activities.

- Interest rates are subject to change based on market conditions.

- The account is best suited for tech-savvy individuals who prioritize high interest and digital banking.

Choosing the right savings account is essential for managing your finances effectively. With numerous options available, you might wonder, is Affirm savings account good for your needs?

This blog post explores the features, benefits, and drawbacks of the Affirm Savings Account to help you make an informed decision.

Is Affirm Savings Account Good?

Saving money is a fundamental aspect of financial stability. A good savings account not only keeps your money safe but also helps it grow through interest.

Affirm, a company known for its financial services, offers a savings account that has caught the attention of many. But is Affirm savings account good? To answer this, let’s delve into its features, benefits, and how it compares to other savings accounts in the market.

What is Affirm Savings Account?

Affirm is a financial technology company that provides various financial services, including loans and savings accounts. The Affirm Savings Account is designed to help users save money efficiently while earning competitive interest rates.

It integrates seamlessly with Affirm’s other services, offering a unified financial management experience.

Key Features

- High-Interest Rates: Affirm offers competitive interest rates compared to traditional banks.

- No Minimum Balance: Users are not required to maintain a minimum balance, making it accessible to everyone.

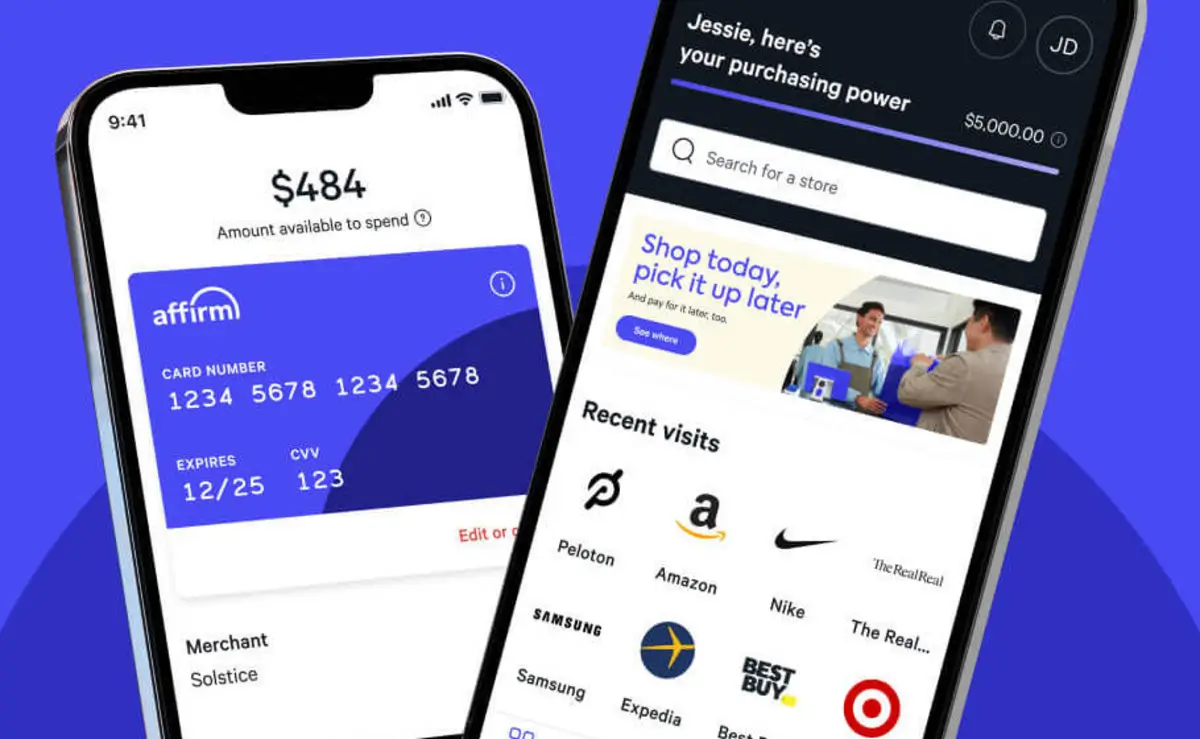

- User-Friendly Interface: The account can be managed through the Affirm app, providing ease of access and management.

- Automatic Savings: Features like automatic transfers help users save consistently without manual intervention.

Benefits of Affirm Savings Account

Understanding the benefits of the Affirm Savings Account can help determine if it aligns with your financial goals.

Competitive Interest Rates

One of the main attractions of the Affirm Savings Account is its high-interest rates. Compared to many traditional savings accounts, Affirm offers better returns on your deposits, allowing your money to grow faster.

Accessibility

Affirm does not impose a minimum balance requirement. This feature makes it easy for individuals who are just starting to save or those who prefer not to keep a large sum in their savings account.

Integration with Other Services

If you already use Affirm for other financial services, such as loans or installment payments, having a savings account within the same platform can simplify your financial management.

Easy Management

Managing your savings account through the Affirm app provides convenience. You can monitor your savings, set goals, and track your progress all in one place.

Drawbacks of Affirm Savings Account

While the Affirm Savings Account has several advantages, it’s important to consider potential drawbacks.

Limited Branch Access

Affirm operates primarily online, which means there are no physical branches. For those who prefer in-person banking, this could be a limitation.

Fees and Penalties

While Affirm offers many free features, it’s essential to review any potential fees or penalties associated with the account, such as withdrawal limits or late fees.

Customer Service

Some users have reported mixed experiences with Affirm’s customer service. Efficient customer support is crucial for resolving any issues promptly.

Availability

Affirm’s services may not be available in all regions, limiting access for some potential users.

Comparing Affirm Savings Account to Traditional Banks

To determine is Affirm savings account good, it’s useful to compare it with traditional banks.

Interest Rates

Affirm generally offers higher interest rates than many traditional savings accounts, providing better returns on your savings.

Accessibility

Traditional banks often have extensive branch networks, offering in-person services. In contrast, Affirm operates online, which may suit tech-savvy users but not those who prefer face-to-face interactions.

Fees

Both Affirm and traditional banks may have fees, but Affirm’s no minimum balance requirement can be more attractive for users looking to avoid certain fees.

Integration

Affirm’s integration with other financial services can be a plus for users who want a unified platform, whereas traditional banks may require multiple accounts for different services.

Customer Reviews and Feedback

Customer experiences can shed light on is Affirm savings account good. Reviews highlight both strengths and areas for improvement.

Positive Feedback

- High Returns: Many users appreciate the higher interest rates.

- Ease of Use: The app’s user-friendly design is frequently praised.

- No Minimum Balance: Users value the flexibility of not needing a minimum balance.

Negative Feedback

- Customer Service: Some users have reported delays in customer support responses.

- Limited Services: The lack of physical branches and limited additional services can be a downside for some.

Is Affirm Savings Account Good for You?

Deciding whether the Affirm Savings Account is right for you depends on your financial needs and preferences.

Who Benefits Most

- Tech-Savvy Individuals: Those comfortable with online banking will find Affirm’s digital platform convenient.

- High Savers: Users looking to maximize their interest earnings will benefit from Affirm’s competitive rates.

- Flexible Savers: Individuals who prefer not to maintain a minimum balance will appreciate Affirm’s accessibility.

Who Might Look Elsewhere

- In-Person Banking Enthusiasts: Those who prefer visiting bank branches may find Affirm’s online-only model limiting.

- Those Needing Comprehensive Services: Users seeking a wide range of financial products might need to consider additional banking services beyond what Affirm offers.

Security and Safety

When evaluating is Affirm savings account good, security is a critical factor. Affirm employs robust security measures to protect user data and funds.

FDIC Insurance

Affirm Savings Accounts are FDIC insured up to the standard limit, ensuring that your money is safe even if Affirm were to face financial difficulties.

Encryption

Affirm uses advanced encryption technologies to safeguard your personal and financial information from unauthorized access.

Secure Access

Features like two-factor authentication add an extra layer of security, making it harder for unauthorized users to access your account.

Interest Rates and How They Compare

Interest rates play a significant role in determining whether is Affirm savings account good. Affirm offers competitive rates that often surpass those of traditional banks.

Current Rates

Affirm provides higher interest rates, which means your savings grow faster compared to standard savings accounts.

Rate Variability

It’s important to note that interest rates can fluctuate based on market conditions. Affirm regularly reviews and adjusts rates to remain competitive.

Compound Interest

Affirm calculates interest daily and compounds it monthly, maximizing the growth potential of your savings.

Account Management and Features

Effective account management is essential for a good savings experience. Affirm offers several features that enhance user convenience.

Mobile App

The Affirm app allows you to manage your savings account on the go. You can monitor balances, set savings goals, and transfer funds with ease.

Automatic Transfers

Setting up automatic transfers helps you save consistently without having to remember to move money manually.

Goal Setting

Affirm lets you set specific savings goals, providing a clear path to achieving your financial targets.

Notifications

Real-time notifications keep you informed about your account activity, helping you stay on top of your finances.

Fees and Costs

Understanding the fee structure is crucial when assessing is Affirm savings account good. Affirm strives to keep fees minimal.

No Monthly Fees

Affirm does not charge monthly maintenance fees, allowing you to save without worrying about recurring costs.

Withdrawal Limits

There may be limits on the number of withdrawals you can make each month, similar to other savings accounts.

Overdraft Protection

Affirm offers overdraft protection to prevent accidental overdraws, though it’s important to understand any associated costs.

Penalty Fees

Late or excessive withdrawals might incur penalty fees, so it’s essential to use the account responsibly.

Customer Support and Service

Reliable customer support is vital for a positive banking experience. When considering is Affirm savings account good, the quality of customer service matters.

Support Channels

Affirm provides customer support through various channels, including email, phone, and in-app messaging, ensuring you can reach help when needed.

Response Times

While many users report satisfactory response times, some have experienced delays. It’s important to consider this aspect based on your personal preferences.

Help Resources

Affirm offers a comprehensive FAQ section and other resources to help you navigate any issues independently.

How to Open an Affirm Savings Account

If you decide that the Affirm Savings Account suits your needs, the process to open an account is straightforward.

Eligibility Requirements

- Age: You must be at least 18 years old.

- Identification: Provide a valid ID, such as a driver’s license or passport.

- Social Security Number: Required for identity verification and tax purposes.

Application Process

- Download the App: Get the Affirm app from your smartphone’s app store.

- Create an Account: Sign up using your email address and create a secure password.

- Provide Information: Enter your personal and financial details as required.

- Verify Identity: Complete the identity verification process by submitting necessary documents.

- Fund Your Account: Transfer money from an existing bank account to start saving.

Timeframe

Once you complete the application, approval is usually quick, and you can start using your account almost immediately.

Maximizing Your Savings with Affirm

To make the most out of your Affirm Savings Account, consider these tips.

Set Clear Goals

Define what you are saving for, whether it’s an emergency fund, a vacation, or a major purchase. Clear goals can motivate you to save consistently.

Automate Savings

Use Affirm’s automatic transfer feature to ensure you save regularly without having to remember each time.

Monitor Your Progress

Regularly check your account to track your savings growth and make adjustments as needed to stay on target.

Take Advantage of Interest

Keep your savings in the account to benefit from the high-interest rates and compound growth.

Pros and Cons Summary

When evaluating is Affirm savings account good, it’s helpful to summarize the pros and cons.

Pros

- High-interest rates

- No minimum balance requirement

- User-friendly mobile app

- Automatic savings features

- FDIC insured

Cons

- No physical branches

- Mixed customer service reviews

- Limited additional financial services

- Possible fees for excessive withdrawals

Alternatives to Affirm Savings Account

If you are considering is Affirm savings account good, you might also want to look at other options to ensure you choose the best fit.

Traditional Banks

Traditional banks offer extensive services and physical branches, which can be beneficial for those who prefer in-person banking.

Online Banks

Online banks often provide high-interest rates similar to Affirm, with the added benefit of digital management without any physical branches.

Credit Unions

Credit unions can offer competitive rates and personalized service, though they may have membership requirements.

Fintech Alternatives

Other financial technology companies provide innovative savings solutions that might better suit specific needs.

Frequently Asked Questions

Here are some of the related questions people also ask:

Is Affirm Savings Account a good option for saving money?

Yes, Affirm Savings Account offers competitive interest rates, no minimum balance, and a user-friendly app, making it a good option for digital banking users.

What are the benefits of using Affirm Savings Account?

The key benefits include high-interest rates, no minimum balance requirement, easy mobile management, automatic savings features, and FDIC insurance.

Does Affirm Savings Account have any hidden fees?

Affirm does not charge monthly maintenance fees, but users should review potential penalties for excessive withdrawals or other account activities.

How does Affirm Savings Account compare to traditional bank accounts?

Affirm offers higher interest rates and no minimum balance but lacks physical branches and extensive financial services that traditional banks provide.

Is Affirm Savings Account safe to use?

Yes, Affirm Savings Account is FDIC insured, uses encryption for security, and offers two-factor authentication for secure access.

Can I withdraw money anytime from my Affirm Savings Account?

Yes, but like most savings accounts, there may be limits on the number of withdrawals per month, and exceeding this limit could result in penalties.

How do I open an Affirm Savings Account?

You can open an account through the Affirm app by providing your personal details, verifying your identity, and funding the account.

What is the current interest rate for Affirm Savings Account?

Interest rates vary based on market conditions, so it’s best to check Affirm’s official website for the latest rates.

Who should use Affirm Savings Account?

It is ideal for tech-savvy individuals who want a high-yield savings account with no minimum balance and prefer online banking.

The Bottom Line

Deciding is Affirm savings account good involves weighing its benefits against potential drawbacks. Affirm offers a high-interest, accessible savings account that is managed through a user-friendly app, making it an attractive option for many. Its lack of a minimum balance requirement and integration with other Affirm services add to its appeal. However, the absence of physical branches and mixed customer service experiences may be a concern for some users.

Ultimately, if you value higher interest rates, ease of use, and digital management, the Affirm Savings Account could be a good choice for you. It’s essential to assess your personal financial needs and preferences to determine if Affirm aligns with your savings goals.

By carefully considering the features, benefits, and potential limitations, you can make an informed decision on whether is Affirm savings account good for your financial future. Always compare different options and choose the one that best fits your unique situation to maximize your savings effectively.