We may earn a commission for purchases through links on our site, Learn more.

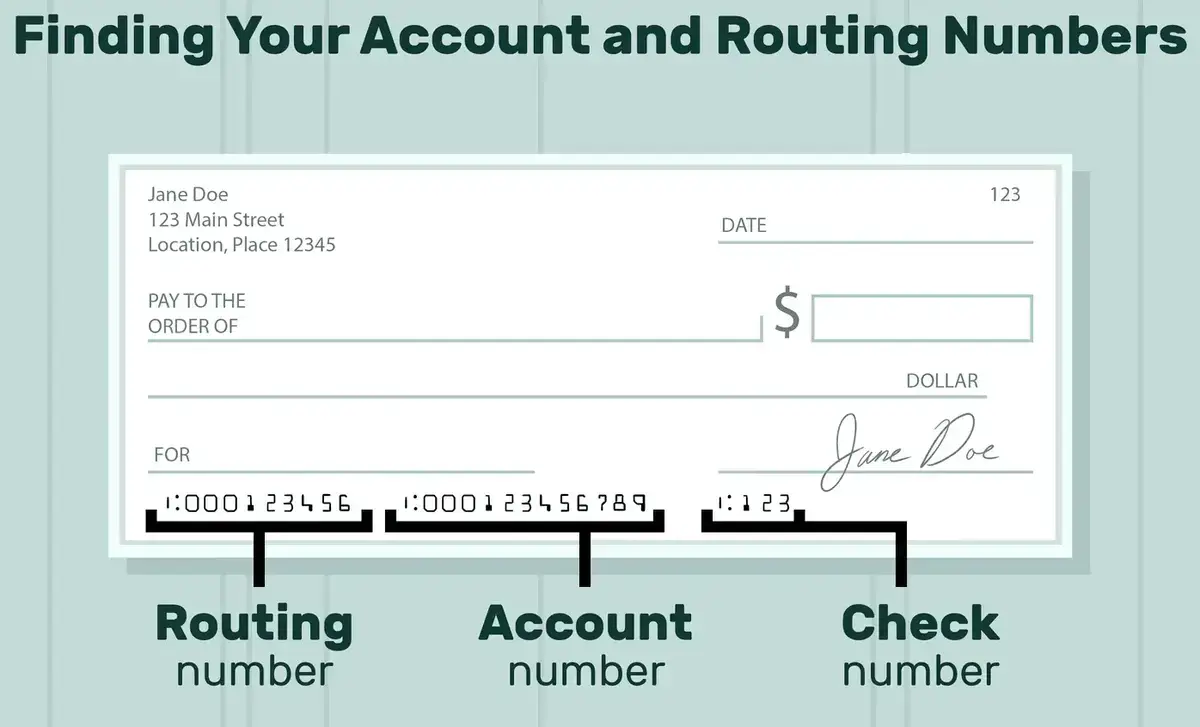

At the bottom of a check, you’ll find three sets of numbers. The first set is your routing number, the second is your account number, and the third is your check number.

Your account number is a crucial piece of information associated with your bank account. It serves as a unique identifier for your specific account and plays a pivotal role in various banking transactions. This alphanumeric sequence is typically located on the bottom of a physical check, specifically in the section known as the MICR (Magnetic Ink Character Recognition) line.

Account number on a check?

To be more precise, if you examine the MICR line on the bottom of your check, you’ll notice a series of three distinct numbers. The first set of numbers is the nine-digit routing number, which helps financial institutions route transactions accurately. The second set of numbers, immediately following the routing number, is your account number. It’s essential to differentiate this from the routing number, as the two serve separate functions in the processing of transactions.

Your account number acts as a personalized code that enables your bank to pinpoint your individual account amidst their vast network of customers. This precision is crucial to ensure that deposits, withdrawals, transfers, and other financial activities are accurately attributed to your specific account. By locating this account number on your check, you’re effectively providing the information needed for a range of activities, from direct deposits and electronic fund transfers to reconciling payments.

In conjunction with the third set of numbers on the MICR line, known as the check number, your account number helps create a unique combination that safeguards against errors and fraud. It’s imperative to keep your account number confidential, as it holds the potential to grant unauthorized access to your account and personal information.

While physical checks are becoming less common with the rise of digital banking, understanding the significance of your account number remains relevant in various financial contexts. Whether you’re initiating a wire transfer, setting up automatic bill payments, or verifying your identity for customer service inquiries, your account number remains an essential element in the intricate network of modern banking processes.

What is the account number on a check?

The account number on a check is an important piece of information used to uniquely identify and link to a specific bank account associated with the individual or entity issuing the check. This number plays a pivotal role in the smooth processing of financial transactions and ensures that funds are accurately debited from the correct account. The account number acts as a key that grants access to the specific pool of funds associated with the account holder.

When a check is presented for payment, whether it’s for personal expenses, bill payments, or other financial transactions, the account number is utilized by the banking system to verify the availability of funds and execute the necessary transfer. This step is part of the broader process that involves the routing number, which identifies the financial institution where the account is held. Together, the routing number and the account number work in tandem to pinpoint the exact source of funds and facilitate a seamless transfer of money.

It’s essential to ensure the accuracy of the account number when filling out checks or providing this information for electronic transactions. Mistakes in the account number can lead to various complications. For instance, if the account number is incorrect, the funds might not be withdrawn from the intended account, causing delays or declined transactions. Furthermore, discrepancies could lead to issues such as missed bill payments, overdrafts, or even potential fees.

It’s worth noting that individuals or entities with multiple checking accounts, such as a combination of personal and business accounts, will have distinct account numbers for each account. This differentiation is necessary to maintain proper financial record-keeping and to accurately attribute transactions to the correct account.

In terms of the structure of account numbers, they can vary in length but typically consist of up to 12 digits. This alphanumeric combination is carefully designed to uniquely identify each account while adhering to standardized formats established by the financial industry. The account number’s length and format might differ from one financial institution to another, but the fundamental purpose remains the same: to ensure precise and secure movement of funds.

In conclusion, the account number on a check serves as a vital identifier for a specific bank account. Its accurate use is crucial for successful financial transactions, timely bill payments, and the overall maintenance of sound financial records. The combination of the routing number and account number forms the backbone of the banking system, enabling secure and efficient movement of funds while minimizing the potential for errors and disruptions.

Other ways to find your account number:

Find your account number on a paper statement

If you have a paper bank statement or an electronic (PDF) version of it, your account number should be listed at the top of the statement as “account number,” followed by a series of numbers.

- Paper Statement: When you have a physical paper statement, follow these steps to locate your account number:

- Step 1: Look at the top section of the paper statement. This is usually where your personal and account information is displayed, including your name, address, and account details.

- Step 2: Scan the top section for labels or headings that indicate your account information. You’re specifically looking for the term “account number.”

- Step 3: Once you’ve located the “account number” label, your account number will be the sequence of numbers that follows it. It may be a series of digits, usually ranging from 8 to 12 digits. Sometimes, it’s separated by hyphens or other characters for better readability.

- Step 4: Take note of this account number. It’s essential to keep it confidential and secure, as it’s used for various banking transactions.

- Electronic (PDF) Statement: If you have an electronic version of your bank statement in PDF format, the process is quite similar:

- Step 1: Open the PDF statement using a PDF viewer or reader software on your computer or device.

- Step 2: Navigate to the first page of the PDF, where your account information is typically displayed.

- Step 3: Similar to the paper statement, locate the section that contains your account details. Look for the label “account number.”

- Step 4: Following the “account number” label, you’ll find the numerical sequence that constitutes your account number. As mentioned earlier, it might have formatting elements to enhance readability.

- Step 5: Make sure to jot down or save this account number in a secure location.

Remember that your account number is sensitive information and should be kept confidential. It’s used for various purposes, including making deposits, transferring funds, and verifying your identity during transactions. If you’re ever unsure about which number is your account number, you can always reach out to your bank’s customer service for assistance.

Find your account number through online banking

To find your account number through online banking, follow these steps to access your bank account via the bank’s online portal:

- Access the Online Portal: Open a web browser and navigate to your bank’s official website. Look for the “Login” or “Sign In” option to access the online banking portal.

- Enter Credentials: Enter your username and password in the provided fields. These credentials should have been set up when you first registered for online banking. If you haven’t registered yet, there should be an option to sign up or enroll.

- Security Measures: Some banks might implement additional security measures, such as two-factor authentication. You might receive a code on your registered mobile number or email that you need to enter to proceed.

- Navigate to Account Information: Once logged in, you’ll be directed to your account dashboard or summary page. Look for options like “Account Information,” “Account Details,” or something similar. This section typically displays your account-related details.

- Locate Account Number: In the account information section, you’ll likely find your account number listed. It might be a series of digits associated with your specific account. However, due to security reasons, some banks might partially cloak or mask part of the account number.

- Reveal Hidden Digits: If your bank cloaks part of the account number for security purposes, you’ll likely see an option like “Show” or “Reveal” adjacent to the masked digits. Click on this prompt to display all the digits of your account number.

- Confirmation: After revealing the complete account number, take a moment to double-check the displayed information. Make sure you’re noting down the accurate account number to avoid any errors in future transactions.

- Note or Save: Write down your complete account number or take a screenshot for your records. Additionally, consider saving this information in a secure and easily accessible location, such as a password manager or a secure notes application.

Remember to log out of your online banking session once you’ve retrieved the necessary information to ensure the security of your account. It’s also advisable to avoid accessing your account through public or unsecured Wi-Fi networks to prevent any potential security breaches.

Call your bank and ask for your account number

If you find yourself in need of your account number, reaching out to your bank is the logical step. A customer service representative, who is well-versed in assisting customers with their account-related inquiries, will be your go-to source. When you call your bank and request your account number, you’ll likely be connected with one of these knowledgeable representatives.

Once on the line, the representative will prioritize the security of your personal information. They will begin by confirming your identity to ensure they’re providing sensitive information to the rightful account holder. This verification process often involves a series of security questions. These questions might be related to specific details about your account, recent transactions, or personal information that you’ve previously provided to the bank. This stringent security protocol is designed to prevent unauthorized access to your account information.

After successfully passing the security verification, the customer service representative will be more than willing to assist you. They’ll provide you with your account number, which is a vital piece of information for various transactions, including setting up direct deposits, making electronic transfers, or managing your account online.

It’s worth noting that the bank’s commitment to security doesn’t end with the call. They track and monitor such interactions to ensure that their customers’ sensitive data remains safeguarded. This meticulous approach reflects the bank’s dedication to protecting your financial well-being.

What is the routing number on a check?

The routing number on a check serves as a crucial identifier within the realm of banking and financial transactions. While the bank account number specifies the particular account associated with the check, the routing number plays the role of designating the financial institution where that account is held. In essence, the routing number acts as a navigational code, guiding transactions to the appropriate destination.

In practical terms, routing numbers are indispensable for various financial operations. They are especially integral in the processes of check processing and wire transfers. When a check is presented for payment, the routing number helps streamline the transaction by indicating which bank needs to facilitate the fund transfer. Similarly, when initiating a wire transfer, the routing number ensures that the funds are routed accurately to the intended recipient’s bank.

To locate the routing number on a check, you would need to look at the lower portion of the check. It typically appears as the first sequence of numbers, positioned on the left-hand side. Comprising nine digits in total, the routing number holds vital information about the financial institution’s location and branch. This unique combination of digits aids in maintaining order and precision in the intricate web of financial operations.

In summation, the routing number plays a pivotal role in the orchestration of financial transactions. It bridges the gap between different banks and financial institutions, ensuring that the funds flow smoothly and securely from one account to another. Its presence on a check is a testament to the meticulous system that underpins modern banking, facilitating the movement of money with accuracy and efficiency.

How many digits is the account number? 10-12 digits

The account number serves as a pivotal piece of information, acting as a unique identifier that distinguishes one account holder from another within a specific financial institution. Typically consisting of a sequence of 10 to 12 digits, the account number plays a fundamental role in enabling seamless and accurate transaction processing.

When initiating any bank-related financial transaction, whether it be depositing funds, making a withdrawal, setting up direct deposits, or facilitating electronic transfers, both the routing number and the account number are essential components. The routing number functions as a sort of postal code for banks, pinpointing the specific financial institution to which the transaction should be directed. On the other hand, the account number delves deeper, honing in on the individual account associated with the transaction.

The account number’s length, typically ranging from 10 to 12 digits, may vary slightly depending on the specific bank and its internal account numbering system. These numbers are not randomly assigned but are carefully structured to provide a standardized format that allows for efficient and accurate processing of transactions while also maintaining security and confidentiality.

As a critical piece of sensitive information, account numbers are safeguarded by financial institutions to ensure the security and privacy of their customers’ financial assets. The complexity of the account number’s structure and the stringent security measures surrounding it are designed to deter unauthorized access and potential fraud.

Image: the balance