We may earn a commission for purchases through links on our site, Learn more.

- Klarna purchase power is an estimate of how much you can spend using Klarna’s pay later options.

- Payment history is a key factor influencing your Klarna purchase power.

- Outstanding balance affects your available purchase power; lower balances can increase it.

- The store and payment option you choose may impact your purchase power.

- Paying on time consistently can help boost your Klarna purchase power.

- Reducing your outstanding balance can free up more purchase power.

- Settling overdue or failed payments promptly is crucial for restoring purchase power.

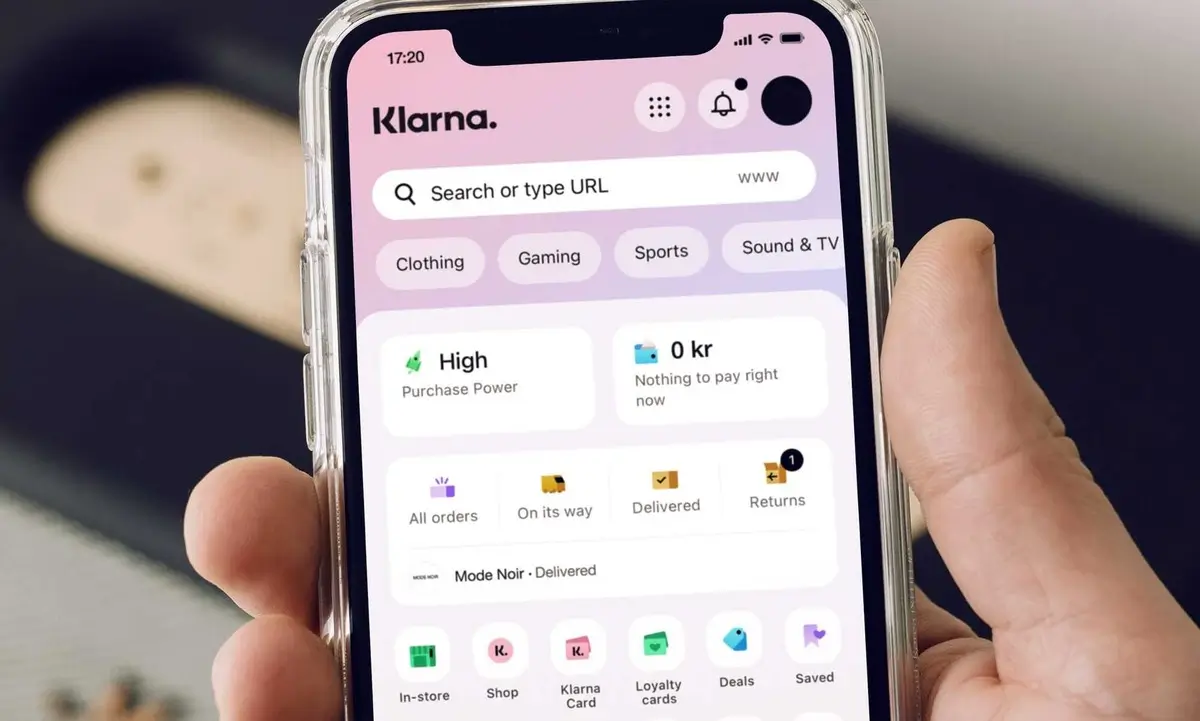

- You can check your Klarna purchase power in the Klarna app.

- Klarna’s browser shopping extension shows your purchase power when creating a one-time card.

In the world of online shopping, flexibility and convenience are key. Klarna, a leading payment solutions provider, offers customers the ability to buy now and pay later. A crucial aspect of using Klarna’s services is understanding your Klarna purchase power.

So, what is Klarna purchase power? Klarna purchase power is an estimate of how much you can spend using Klarna’s pay later options. This estimate is based on your payment history and outstanding balance. Understanding your Klarna purchase power helps you make informed purchasing decisions and manage your finances effectively.

Introduction

Online shopping has transformed the way we buy products and services. With the rise of payment solutions like Klarna, consumers enjoy greater flexibility in managing their purchases. Klarna’s “buy now, pay later” options allow shoppers to spread payments over time, making larger purchases more accessible. However, to use these options effectively, it’s essential to understand what is Klarna purchase power.

This blog post delves into what Klarna purchase power means, the factors that influence it, how to increase your purchase power, and ways to check it. By the end, you’ll have a clear understanding of how to maximize your Klarna experience.

What is Klarna Purchase Power?

Klarna purchase power is an estimate of how much you can spend using Klarna’s pay later options. This estimate is calculated based on your payment history and outstanding balance with Klarna.

Essentially, it represents the credit limit that Klarna extends to you for making purchases. The higher your Klarna purchase power, the more you can spend without immediate payment. This flexibility can enhance your shopping experience, allowing you to manage your finances more effectively.

Factors That Affect Your Purchase Power

Understanding the factors that affect your purchase power is crucial for managing your spending and maintaining a healthy financial relationship with Klarna. Several key elements influence your Klarna purchase power:

Payment History: How Consistently You’ve Made Payments on Time

Your payment history is a significant factor in determining your Klarna purchase power. Klarna reviews how consistently you’ve made payments on time.

If you have a history of timely payments, Klarna is more likely to increase your purchase power. Conversely, missed or late payments can negatively impact your purchase power. Maintaining a good payment record demonstrates your reliability and ability to manage credit responsibly.

Outstanding Balance: How Much You Still Owe Klarna

Another important factor is your outstanding balance with Klarna. This refers to the amount you currently owe for previous purchases. A higher outstanding balance can reduce your Klarna purchase power because it indicates that you have existing financial obligations.

Keeping your outstanding balance low by making regular payments can help increase your purchase power, giving you more flexibility for future purchases.

Store and Payment Option: The Store You’re Shopping At and the Payment Option You Choose

The store where you choose to shop and the specific payment option you select can also affect your Klarna purchase power. Different retailers may have varying agreements with Klarna, which can influence the available credit.

Additionally, the type of payment option—such as pay later, installment plans, or financing—can impact your purchase power. Some payment options may require a higher purchase power, while others may be more lenient.

How to Increase Your Purchase Power

If you’re looking to boost your Klarna purchase power, there are several effective strategies you can employ. By focusing on your payment habits and managing your outstanding balance, you can enhance your purchase power over time.

Pay on Time

One of the most effective ways to increase your purchase power is to pay your Klarna bills on time. Consistently making timely payments demonstrates your reliability and financial responsibility.

Klarna rewards customers who manage their payments well by increasing their purchase power. Setting up automatic payments or reminders can help ensure you never miss a due date.

Make Payments Towards Your Outstanding Balance

Reducing your outstanding balance is another key strategy to increase your Klarna purchase power. By paying down what you owe, you free up more credit for future purchases.

Regularly making payments towards your outstanding balance shows Klarna that you are actively managing your debt, which can positively influence your purchase power.

Settle Any Overdue or Failed Payments

If you have any overdue or failed payments, it’s important to settle them as soon as possible. Overdue payments can significantly impact your Klarna purchase power, making it harder to access credit for new purchases.

By addressing any missed payments promptly, you can mitigate negative effects and work towards restoring your purchase power.

How to Check Your Purchase Power

Knowing your Klarna purchase power is essential for planning your purchases and avoiding overspending. Klarna provides several convenient ways to check your purchase power, ensuring you stay informed about your available credit.

You Can See Your Estimated Purchase Power in the Klarna App

The Klarna app is a user-friendly tool that allows you to monitor your purchase power in real-time. Within the app, you can view your estimated purchase power, along with details about your payment history and outstanding balance. This feature helps you stay aware of your financial standing and make informed shopping decisions.

You Can See Your Estimated Purchase Power When Creating a One-time Card Using the Klarna Shopping Extension on Your Browser

In addition to the app, Klarna offers a shopping extension for your browser that provides access to your purchase power. When you create a one-time card through the extension, your estimated purchase power is displayed. This integration makes it easy to check your credit limit while browsing and shopping online, ensuring you have the information you need at your fingertips.

Frequently Asked Questions

Here are some of the related questions people also ask:

What is Klarna purchase power based on?

Klarna purchase power is based on your payment history, outstanding balance, and the store and payment option you choose.

Why is my Klarna purchase power low?

Your Klarna purchase power may be low due to missed or late payments, a high outstanding balance, or limitations based on the store or payment option.

How can I increase my Klarna purchase power?

You can increase your Klarna purchase power by paying on time, reducing your outstanding balance, and settling any overdue or failed payments.

Does Klarna check credit scores for purchase power?

Klarna typically performs a soft credit check to assess your eligibility but relies heavily on your payment history and outstanding balance for purchase power.

Can my Klarna purchase power change?

Yes, Klarna purchase power can change depending on your payment behavior, the amount you owe, and other financial factors.

Where can I check my Klarna purchase power?

You can check your Klarna purchase power in the Klarna app or through the Klarna shopping extension when creating a one-time card.

Does having an overdue payment affect my Klarna purchase power?

Yes, overdue payments can significantly reduce your Klarna purchase power until they are settled.

What is a one-time card, and how does it relate to Klarna purchase power?

A one-time card is a virtual card created for specific purchases, and your Klarna purchase power determines the spending limit for the card.

Can Klarna purchase power differ between stores?

Yes, Klarna purchase power may vary depending on the store’s policies and the payment options available.

The Bottom Line

Understanding what is Klarna purchase power is essential for making the most of Klarna’s pay later options. Klarna purchase power is an estimate of how much you can spend using Klarna’s services, based on your payment history and outstanding balance. By maintaining a good payment record, managing your outstanding balance, and choosing appropriate payment options, you can increase your purchase power over time.

Additionally, staying informed about your purchase power through the Klarna app or browser extension ensures you make smart and informed purchasing decisions. Klarna purchase power offers flexibility and convenience, enhancing your online shopping experience while promoting responsible financial management.

By following these guidelines and actively managing your Klarna account, you can maximize the benefits of Klarna’s payment options. Whether you’re making small purchases or larger investments, understanding and optimizing your Klarna purchase power ensures you have the financial flexibility you need. Embrace the convenience of buy now, pay later with Klarna, and take control of your shopping and financial future.